December Confessions #2 December 31, 2008

Posted by Ali in analysis, kuwait.Tags: global, investment, kuwait, TID

4 comments

During December the market confessed three important facts. The first is that the Kuwait Investment Authority (KIA) will not provide the optimism needed to restore confidence in the market. The second is that investment banks will fail in succession amid the greatest government intervention since souk almanakh. Finally that oil prices will no longer be controlled by the oil cartel, OPEC.

Investment Banks Collapse

During this crisis many speculators believed that investment companies would not fare well, but none could fathom the utter failure of Global Investment House (Global) or The Investment Dar (TID). This is labeled as another of the December surprises that would rattle the local economy once more following the collapse of Gulf Bank of Kuwait a few weeks earlier.

On December 16th, Fitch downgraded Global five notches down to C, in other words Global went from “investment grade” to “junk.” Global was downgraded because of its default on a payment to WestLB. That was a shock to investors in the market. Investors were not expecting Global to default. Although a few weeks earlier, we heard in the market about TID defaults and the possibility of Global’s default, still it was hard to believe to see these two gigantic investment banks failing. (more…)

December Confessions #1 December 30, 2008

Posted by Ali in analysis, kuwait, Regulation.Tags: December Confessions, Intervention, investment

6 comments

During December the market confessed three important facts. The first is that the Kuwait Investment Authority (KIA) will not provide the optimism needed to restore confidence in the market. The second is that investment banks will fail in succession amid the greatest government intervention since souk almanakh. Finally that oil prices will no longer be controlled by the oil cartel, OPEC.

The Mega Fund Investment Strategy

Over the previous month Mustafa Al-Shamaly, Minister of Finance, gave three different statements, over a period of three weeks regarding the date of the first acquisition of the Mega Fund. Following the third statement investor confidence turned to a new low as speculators lost faith in the market or the very existence of the Fund. (more…)

A look into Global’s Assets: The Insolvency Question December 28, 2008

Posted by Ali in analysis, kuwait.Tags: Bankruptcy, global, investment

7 comments

Investopedia.com defines insolvency as the company status when its liabilities value exceeds its assets value. In other words, it is the status at which it becomes impossible for the company to satisfy its debt obligations. In my previous post, Globals Desolution, I explained the dire seriousness that Global Investment House (Global) is facing this time I will use numbers to emphasize my point. (more…)

Report: Global’s Desolation December 23, 2008

Posted by Ali in analysis, kuwait.Tags: global, investment, kuwait, Report

8 comments

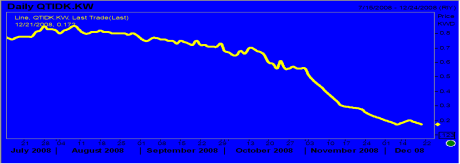

Global Investment House (Global), was incorporated in 1998 by a group of mid-age Kuwaiti entrepreneurs who used to work for Kuwait Investment Company. Global has been lead by Mrs. Maha Al-Ghunaim since inception. Global started in 1998 with market cap of KD 15 millions, and by June 2008 its market cap grew to KD 1.5 billion.

Global growth was initially driven by fees and commission, as the company was focused on private placements and marketing its funds. However, when the company started to grow larger and faster these core business earnings became more difficult to grow, thus Global became more aggressive in its investments. Global’s recent growth and return were coming mainly from their investment activities (Chart 1).  (more…)

(more…)

May i please have my salary… December 21, 2008

Posted by mylastresort in kuwait.Tags: AlDar, Employee, investment, kuwait

6 comments

The roles have been reversed. In the summer foreign labor staged rally’s and a violent protest to claim past salaries, today citizens will experience the true nature of ‘karma.’ Due to the current crisis it has been brought to our attention that The Investment Dar will not being giving any employees bonuses this year. Employee salaries for the month of November have been delayed and employees will be grateful if they receive their December salaries. (more…)

CBK: Breaking the Bank September 28, 2008

Posted by mylastresort in analysis, rumors.Tags: Bank of England, Breaking the Bank, CBK, Central Bank of Kuwait, Crisis, economy, George Soros, Hedge fund, investment, Speculators

2 comments

Currency speculators have for years been tackling central banks in surprise attacks in an effort to reap large rewards from ‘breaking the bank’.

One of the most memorable events was ‘Black Wednesday’ of 1992 which took the Sterling Pound off of its goals of joining the European Central Bank (ECB). In 1992, currency speculators unexpectedly attacked the Bank of England (BOE) forcing it to alter the strict regulations associated with joining the union. Later, the BOE was not able to conform to the standards set by the ECB forcing it out of the European Union (EU). (more…)

HSBC advises on King Abdullah Economic City September 2, 2008

Posted by mylastresort in analysis, saudi arabia.Tags: HSBC, investment, King Abdullah City, saudi arabia

1 comment so far

HSBC has won a contract to advise on the infrastucture projects at the King Abdullah Economic

City, a project worth $15 bil. The project looks very promising but like most Gulf countries projects:

I will believe it when I see it

Agility gets new contract August 25, 2008

Posted by mylastresort in analysis.Tags: Agility, Contract, Gulf, investment, kuwait, Tenders, US Military

comments closed

Kuwaits Agility, the Gulf’s largest logistics company, has just announced that it had won a contract worth $140 mil over the next 7 years with the US Marine Corp. Agility is expected to store, distribute, and maintain exquiptment at 20 US bases around the world. The contract is valid for 1 year but can be renewed for up to 7 years.

Stock price unchanged as of the announcement @ 1.080

Warren Buffett to remain bearish August 25, 2008

Posted by mylastresort in analysis.Tags: Berkshire Hathaway, economy, inflation, investment, recession, US, Warren Buffett

add a comment

In a recent article Warren Buffett claimed that the expects a few more bank failures and claims the housing market to remain ‘tough’ over the next 18-24 months. He anticipates a slow recovery in the US economy and does not expect any improvement prior to 2009. Buffett added, Berkshire Hathaway has no bets right now on currencies but is calling the stock markets ‘more attractive’ than a year ago.

This week Warren Buffett toured Canada’s oil sands with his friend Bill Gates this week to understand how the resources are developed, but the billionaire investor said he had no plan to buy into the sector.

“No, no. I go to the movies, but I don’t buy movie companies. I mean, I’m always interested in understanding the math of things and understanding as much as I can about all aspects of business… And what I learn today may be useful to me two years from now. I mean, if I understand the tar sands today and oil prices change or whatever may happen, I’ve got that filed away and I can use it at some later date.”

– Warren Buffett

DW increasing stake in Mirage August 24, 2008

Posted by mylastresort in analysis.Tags: Dubai, Dubai World, investment, MGM Grand, Sovereign wealth fund, uae

add a comment

New Jersey regulators have given the state owned investment group, Dubai World, approval to increase its stake in MGM Mirage by as much as 20%. MGM Mirage is one of the largest, most popular casinos in Atlantic City, New Jersey. I’m surprised at the freedom allocated to UAE sovereign funds since no other Gulf country may publicly invest in the ‘forbidden’ industries. Dubai World is already the second largest shareholder in the entertainment firm.

In more recent news according to an IMF working paper, the UAE’s oil reserves could last 100 years at present output levels and fetch the country net wealth of $1.6 trillion.